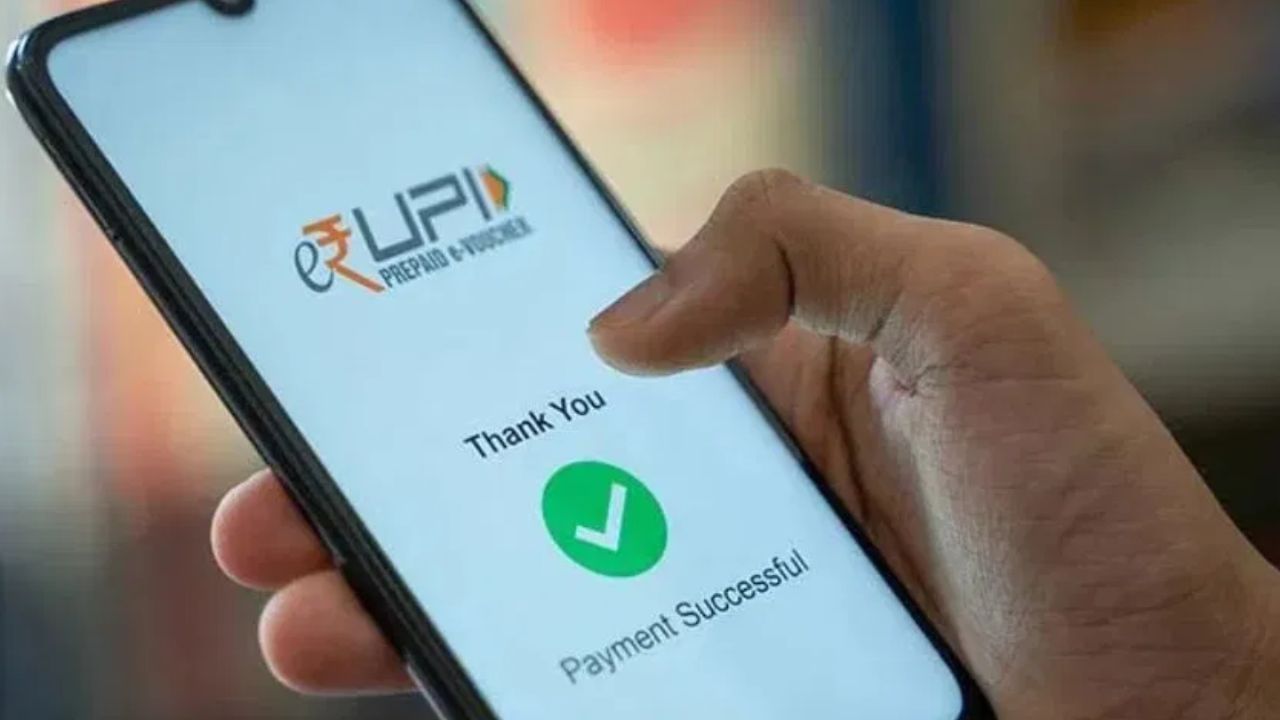

UPI has simplified payments, enabling instant money transfers via mobile numbers or QR codes. However, errors can occur, such as entering the wrong number, adding or omitting a digit, or sending money to the wrong account. A common concern is whether this money can be recovered. This guide explains how to reclaim funds from incorrect UPI transactions.

To begin, immediately check your transaction details. Open your UPI app (Google Pay, PhonePe, Paytm, BHIM UPI) and view your transaction history. Verify the recipient’s account details and note the transaction ID/UTR number. Then, contact your UPI app’s customer support through the help or customer support section, reporting the incorrect transaction with the transaction ID. The app team will attempt to contact the recipient’s bank to recover the funds.

If the app’s solution is insufficient, contact your bank branch or customer care. Provide the transaction ID and date. The bank will request the recipient’s bank to reverse the payment.

If neither the app nor the bank can assist, file a complaint on the NPCI (National Payments Corporation of India) website. For large amounts, report the incident to the nearest police cybercrime cell, providing payment screenshots, transaction ID, and app details. The police and bank will then work together to recover the money.

To prevent such issues, always double-check account numbers/mobile numbers before sending money. When scanning QR codes, confirm the receiver’s name. If a mistake occurs, take immediate action, as delays can complicate the recovery process.

.jpeg)